New LTD Company BTL Lender

Coventry just launched a Limited Company Buy-to-Let Mortgage.

Limited Company BTL, a market that many big lenders have yet to enter, has a new entrant, and they launched a competitive product.

Coventry Building Society (AKA Godiva Mortgages), has entered the Limited Company Buy-to-Let (BTL) market, expanding its well-regarded BTL expertise to cater to landlords operating through Special Purpose Vehicles (SPVs).

This new offering targets a growing segment of professional landlords seeking tax-efficient property investment structures. Here’s a breakdown of the key features:

-

Product Range: Coventry offers 2- and 5-year fixed-rate purchase and remortgage products, providing flexibility for landlords planning short- or medium-term strategies.

-

SPV Flexibility: The product accommodates brand-new limited companies, making it accessible for landlords setting up SPVs for the first time.

-

Portfolio Limits: Landlords can hold up to seven mortgages with Coventry, but the product is not suitable for those with 15 or more properties, limiting its appeal for larger portfolio landlords.

-

Applicant Criteria: Up to four directors or shareholders are accepted, with no minimum income requirement, broadening eligibility. Applicants must be UK residents, current owner-occupiers, and not first-time buyers, though first-time landlords are eligible.

-

Loan Parameters: The maximum loan-to-value (LTV) is 75%, and applicants must be no older than 85 at the end of the mortgage term.

-

Credit and Stress Testing: Coventry maintains a stringent credit policy with minimal tolerance for adverse credit. Rental stress tests are lower for 5-year fixes, offering some relief, but the landlord’s entire portfolio must pass a 5% stress test.

This launch positions Coventry as a competitive player in the Limited Company BTL space, particularly for small to medium-sized landlords seeking straightforward, fixed-rate options through an SPV structure.

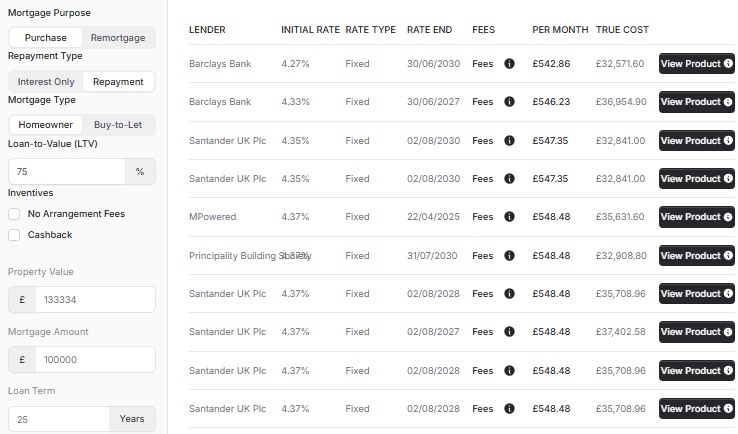

Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

2.20%

2 Years Fixed

2

Years

Fixed

at

2.20%

|

|

|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.30%

2 Years Fixed

2

Years

Fixed

at

2.30%

|

|

|

|

2.40%

2 Years Fixed

2

Years

Fixed

at

2.40%

|

|

|

|

2.40%

2 Years Fixed

2

Years

Fixed

at

2.40%

|

|

The mortgage products shown are for illustrative purposes only and were generated 6 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

No products found for your search criteria.

How it compares

While Coventry’s Limited Company BTL offering is a strong entry, it operates in a competitive market with diverse lender criteria. Here’s how it stacks up against other BTL lenders:

-

Portfolio Size Restrictions: Coventry’s cap on landlords with 15 or more properties is relatively high, as most landlords operate with fewer properties. However, for the minority with larger portfolios, specialist lenders offer more flexibility, with some disregarding properties held in SPVs when assessing eligibility.

-

Loan-to-Value (LTV): The 75% LTV cap is conservative compared to competitors, who offer up to 85% LTV. This higher LTV can be crucial for landlords aiming to maximise borrowing capacity or enter the market with less equity.

-

Age Limits: Coventry’s maximum age of 85 at the end of the mortgage term is restrictive compared to the broader market. Many lenders impose no age limit, while others extend to age 125, catering to landlords who plan to generate long-term rental income in retirement or intend to pass properties on as an inheritance. Coventry’s offering suits those planning to sell in later years.

-

First-time Buyers**: Excluding first-time buyers aligns with mainstream lender policies, but specialist lenders may consider them on a case-by-case basis, offering a niche alternative for new entrants to the property market.

-

Credit History: Coventry’s tight credit criteria, with little room for adverse credit, are stricter than some BTL lenders who allow more leniency for missed or late payments, making them more accessible for applicants with imperfect credit profiles.

-

Stress Testing: The requirement for the entire portfolio to pass a 5% stress test is a notable hurdle. Other lenders may not apply background portfolio stress tests, focusing solely on the property in question, which can simplify the application process for diversified landlords.

Conclusion

Coventry Building Society’s Limited Company BTL product is a welcome addition for landlords using SPVs, particularly those with smaller portfolios, first-time landlords, or those seeking competitive 2- and 5-year fixed rates. Its lower rental stress tests for 5-year fixes and lack of minimum income requirements enhance its appeal. However, its 75% LTV cap, strict credit criteria, and portfolio stress testing may limit its suitability compared to specialist lenders offering higher LTVs, more flexible credit policies, or no age restrictions. Landlords should weigh these factors against their investment goals and consult a mortgage adviser to find the best fit in this dynamic market.

News

- Landlords Ask, "Where Has Precise Gone?" >

-

The Renters Rights Act is now law >

The Renters’ Rights Act just sailed through Royal Assent yesterday. It's officially law now. But here's the good news: nothings changed yet. Likely not kicking in until sometime in early 2026.

-

Can You Get a Mortgage For 6 Times Your Salary? (with Adverse Credit?) >

Borrow up to six times your yearly income.

-

BM Solutions enter LTD Company BTL Market >

The UK's Largest BTL lender starts offering Limited Company Buy-to-Let

-

New 85% LTV BTL Mortgage: Foundation Boosts Competition for Landlords >

More power to landlords! 85% LTV BTL mortgage entry brings fresh competition to existing offering.

-

Bank of England Housing Update (May 2025) >

Bank Base Rate cut to 4.25%

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX