A BTL Mortgage from 2.99% in 2025!

New TMW 2.99% landlord mortgage sounds great, but a 3% fee means it’s not always the best deal!

Landlords, you’ve probably seen the buzz about The Mortgage Works (TMW) launching a shiny new 65% LTV mortgage product with a tempting 2.99% fixed rate for 2 years.

It’s available for both purchase and remortgage, and on a £100,000 interest-only mortgage, you’re looking at monthly payments of just £256.64. Sounds like a steal, right? But hold on—there’s a 3% arrangement fee (£3,000 on that £100,000 loan), and it might not be the best deal, even within TMW’s own range.

Compare that to TMW’s 4.49% 2-year fixed mortgage with no arrangement fees. The monthly payment is higher at £374.17, but you’re saving £3,000 upfront. Yes, the lower rate saves you £117.53 a month, but it would take nearly 26 months to recoup that £3,000 fee—longer than the 24-month term of the mortgage!

Here’s the key takeaway: headline-grabbing low rates aren’t always the best choice. As landlords, you know every penny counts, whether you’re expanding your portfolio or remortgaging an existing property. That’s where working with a mortgage adviser comes in. We can calculate the true cost of a deal over the initial period, factoring in fees, rates, and your unique situation.

You may read from this, "Adam said the higher rate TMW product is better" but don't! In certain circumstances, the 2.99% rate could be better, especially for lower loan amounts.

Sometimes, paying a fee for a lower rate makes sense—like when it improves your rental affordability calculations, helping you meet lender criteria or boost cash flow. Other times, a no-fee deal saves you more upfront and keeps things simple. It all depends on your goals, property value, and loan size.

Don’t get dazzled by a low rate alone. Reach out to a mortgage adviser to crunch the numbers and find the deal that truly works for you. Got questions or want to explore your options? The Cyborg Finance Team would love to help.

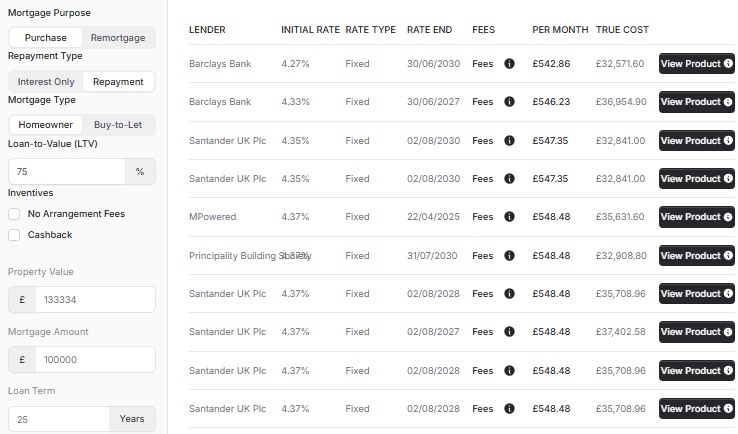

Compare TMW 65% LTV Mortgage Rates

|

Rate

|

Fees

|

|

|---|---|---|

|

2.49%

1 Year Fixed

TBC

TBC

Fixed

at

2.49%

|

|

|

|

2.59%

2 Year Fixed

TBC

TBC

Fixed

at

2.59%

|

|

|

|

2.71%

2 Year Fixed

TBC

TBC

Fixed

at

2.71%

|

|

|

|

3.44%

5 Year Fixed

TBC

TBC

Fixed

at

3.44%

|

|

|

|

3.57%

5 Year Fixed

TBC

TBC

Fixed

at

3.57%

|

|

The mortgage products shown are for illustrative purposes only and were generated 19 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

|

Rate

|

Fees

|

|

|---|---|---|

|

2.49%

1 Year Fixed

TBC

TBC

Fixed

at

2.49%

|

|

|

|

2.59%

2 Year Fixed

TBC

TBC

Fixed

at

2.59%

|

|

|

|

2.71%

2 Year Fixed

TBC

TBC

Fixed

at

2.71%

|

|

|

|

3.44%

5 Year Fixed

TBC

TBC

Fixed

at

3.44%

|

|

|

|

3.57%

5 Year Fixed

TBC

TBC

Fixed

at

3.57%

|

|

The mortgage products shown are for illustrative purposes only and were generated 19 minutes ago. Always consult an independent financial advisor before proceeding with any mortgage. The figures are based on a £100000 property value, a £100000 loan amount and £0 deposit. Initial Fixed Rate on a repayment loan, and a 25-year mortgage term.

News

- Landlords Ask, "Where Has Precise Gone?" >

-

The Renters Rights Act is now law >

The Renters’ Rights Act just sailed through Royal Assent yesterday. It's officially law now. But here's the good news: nothings changed yet. Likely not kicking in until sometime in early 2026.

-

Can You Get a Mortgage For 6 Times Your Salary? (with Adverse Credit?) >

Borrow up to six times your yearly income.

-

BM Solutions enter LTD Company BTL Market >

The UK's Largest BTL lender starts offering Limited Company Buy-to-Let

-

New 85% LTV BTL Mortgage: Foundation Boosts Competition for Landlords >

More power to landlords! 85% LTV BTL mortgage entry brings fresh competition to existing offering.

-

Bank of England Housing Update (May 2025) >

Bank Base Rate cut to 4.25%

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX